Difference Between Tariffs and Duties: Understanding the Nuances in International Trade

Difference between tariffs and duties: While all tariffs are duties, not all duties are tariffs. This fundamental distinction impacts how these charges are applied, collected, and leveraged in trade policy.

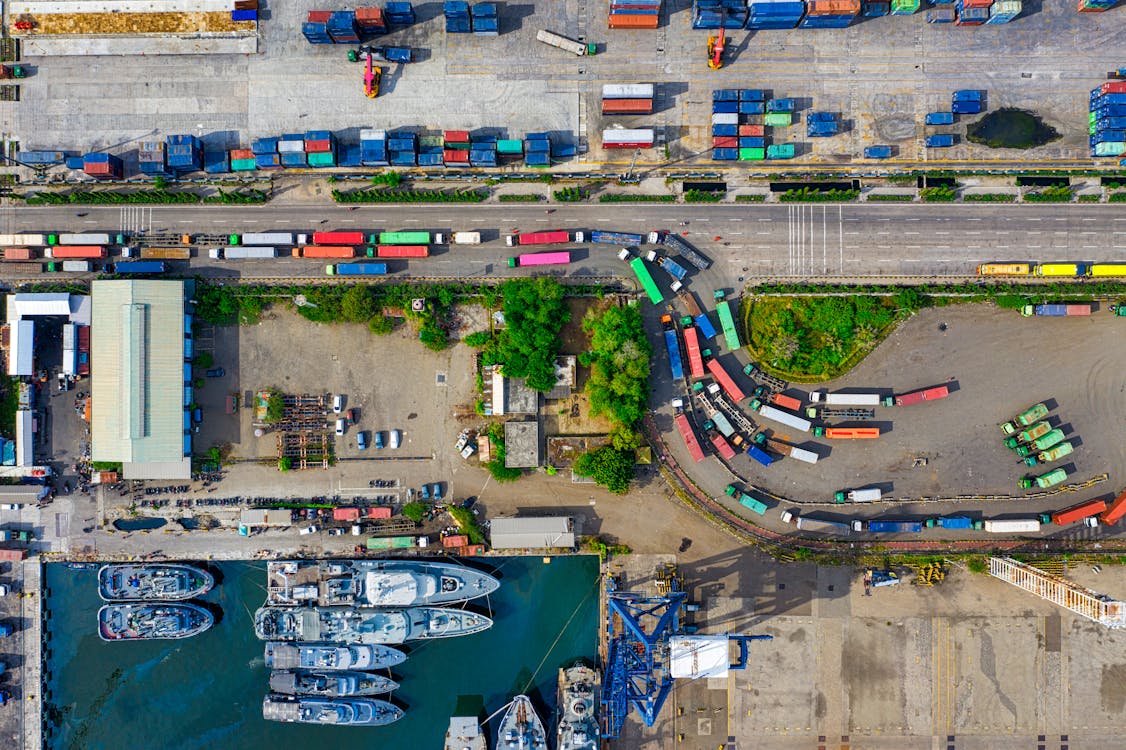

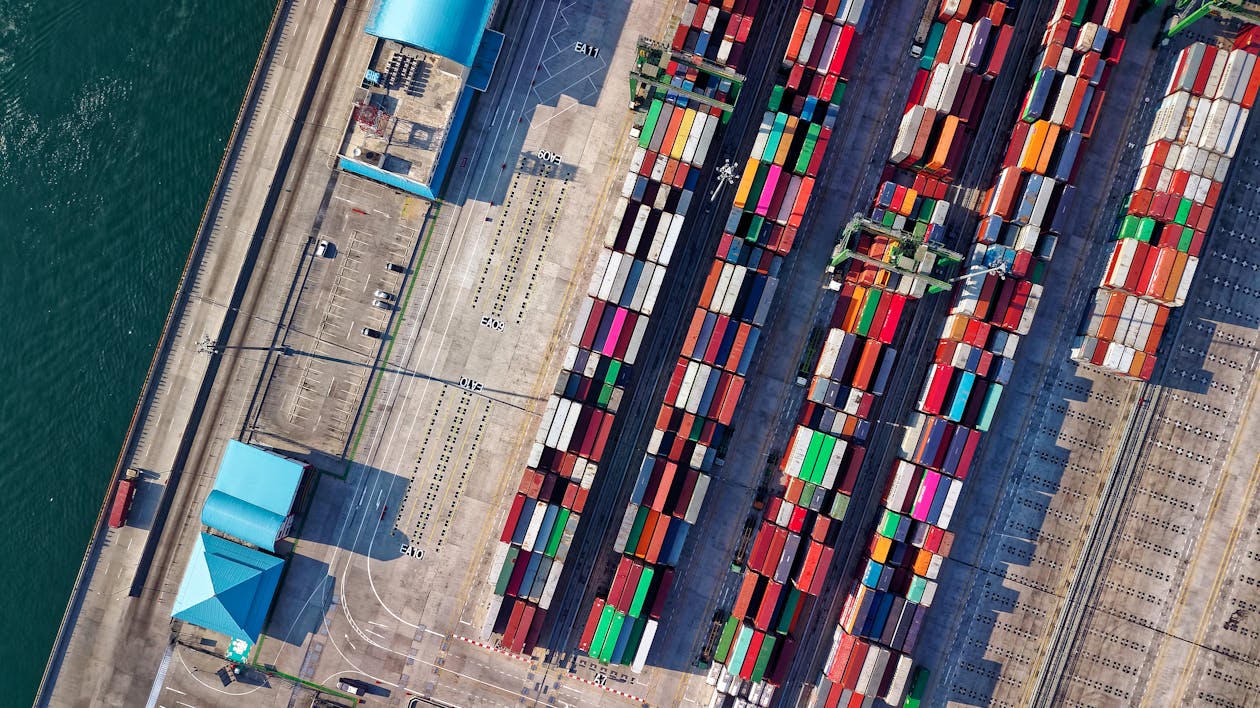

Understanding the difference between tariffs and duties is crucial for businesses involved in international trade. Photo: TariffGlossary.com

As global trade tensions continue to rise and new trade policies reshape international commerce, the terminology used to describe taxes on imported goods has become increasingly important. The difference between tariffs and duties, terms often used interchangeably in news reports and policy discussions, carries significant implications for businesses, consumers, and the global economy.

The Fundamental Distinction

At their core, both tariffs and duties are taxes imposed on goods crossing international borders, but they serve different purposes and operate under distinct frameworks.

"A tariff is a specific type of duty," explains Dr. Elena Martinez, Professor of International Economics at Georgetown University. "While all tariffs are duties, not all duties are tariffs. This is the key distinction that many people, including some policymakers, frequently overlook."

This fundamental difference impacts how these charges are applied, collected, and leveraged in trade policy.

What Exactly Are Duties?

Duties represent the broader category of taxes levied on imported goods. They encompass multiple types of border taxes imposed for various reasons:

Types of Duties Include:

- Customs Duties: The standard tax applied to imported goods.

- Excise Duties: Special taxes on specific products like alcohol, tobacco, or fuel.

- Countervailing Duties: Taxes imposed to offset subsidies provided by exporting countries.

- Anti-dumping Duties: Levies designed to counter the practice of selling goods abroad at prices lower than in the domestic market.

- Safeguard Duties: Temporary protections for domestic industries facing sudden increases in imports.

"Duties serve various purposes beyond revenue generation," notes William Chen, former deputy U.S. Trade Representative. "They can address unfair trade practices, protect national security, or advance environmental and labor standards."

Difference Between Tariffs and Duties

TariffGlossary.comDuties

Broader Category

Umbrella term for all taxes on imported goods

Multiple Types

Include customs, excise, countervailing, anti-dumping, and safeguard duties

Various Purposes

Serve revenue, regulatory, protective, and punitive functions

Different Legal Frameworks

Authorized under various statutes with different requirements

Can Be Non-Trade Related

May serve environmental, safety, or revenue objectives

Tariffs

Subset of Duties

A specific type of duty with distinct characteristics

Trade Policy Tool

Explicitly used as instruments of trade policy and negotiation

Political Significance

Greater political recognition, especially during trade disputes

Often Targeted

Typically directed at specific products, industries, or countries

Can Be Temporary

Often implemented as negotiating tools rather than permanent taxes

Real-World Examples

Duties (Non-Tariff)

- • Anti-dumping duty: 70% duty on Chinese steel products found to be priced unfairly low

- • Countervailing duty: 15% duty on subsidized agricultural products from Country X

- • Excise duty: $2.50 per liter on imported alcohol regardless of origin

Tariffs

- • Section 301 tariffs: 25% on Chinese electronics as part of trade dispute

- • Retaliatory tariffs: EU's 25% tariff on U.S. motorcycles in response to steel tariffs

- • General tariff: 10% baseline tariff on all imported goods under new policy

© 2025 TariffGlossary.com - Understanding the Difference Between Tariffs and Duties

What Makes Tariffs Distinct?

Tariffs represent a specific subset of duties—typically referring to the taxes imposed directly on imported goods for either revenue generation or trade protection purposes.

Key Characteristics of Tariffs:

- Policy Instrument: Tariffs are explicitly used as tools of trade policy, often to protect domestic industries or as bargaining chips in trade negotiations.

- Public Awareness: The term "tariff" has greater political and public recognition, particularly during trade disputes.

- Specificity: Tariffs are typically targeted at particular products, industries, or countries.

- Temporary Nature: Many modern tariffs are implemented as temporary measures during trade conflicts, rather than permanent revenue sources.

"When the president announces new 'tariffs' rather than 'duties,' there's an implicit signal that these are political and negotiating tools rather than routine border taxes," explains Dr. Martinez.

Legal and Administrative Frameworks

The difference between tariffs and duties extends to how they're administered and enforced.

In the United States, the legal authority for various duties comes from different statutes:

- General Tariffs: Established through trade agreements or the Harmonized Tariff Schedule.

- Anti-dumping and Countervailing Duties: Authorized under Title VII of the Tariff Act of 1930.

- National Security Tariffs: Implemented under Section 232 of the Trade Expansion Act of 1962.

- Retaliatory Tariffs: Often authorized under Section 301 of the Trade Act of 1974.

These distinctions matter significantly for importers who must navigate compliance with these various requirements.

The Difference in Practice: Recent Examples

The current administration's trade policies have highlighted the practical difference between tariffs and duties.

Case Study: Recent Steel Imports

When the United States imposed 25% tariffs on steel imports in 2025, some countries faced additional anti-dumping duties of up to 70% on specific steel products. This meant that certain steel imports faced both the general tariff (the 25% tax imposed on all steel imports) and a specific duty (the anti-dumping measure targeting unfairly priced products).

"An importer might face a 25% tariff plus a 70% anti-dumping duty on the same shipment," explains Sandra Rodriguez, customs compliance specialist at Global Trade Solutions. "Understanding the difference between these charges is crucial for accurate cost projections and compliance."

Case Study: Luxury Goods

High-end watches imported from Switzerland incur the standard tariff rate based on the Harmonized Tariff Schedule, but they may also face excise duties based on their luxury status. The combination of these different types of import taxes significantly affects final retail prices.

Why the Difference Matters for Businesses

For businesses engaged in international trade, the distinction between tariffs and duties has practical implications:

- Compliance Requirements: Different duties trigger different reporting and documentation requirements.

- Cost Calculation: Understanding the various types of import taxes enables accurate cost projections.

- Strategic Planning: Companies may locate production facilities in countries with favorable duty treatment, even if tariffs are applied uniformly.

- Trade Remedy Proceedings: Businesses may participate in anti-dumping or countervailing duty investigations, which operate differently from general tariff determinations.

"The companies that successfully navigate today's complex trade environment are those that understand the nuanced difference between tariffs and duties," says Michael Patel, director of international trade at a leading retail association. "This knowledge directly impacts the bottom line."

Consumer Impact

The difference between tariffs and duties also affects consumers, though often invisibly.

General tariffs tend to impact broader categories of goods, potentially raising prices across entire product lines. Specific duties like anti-dumping measures may target particular manufacturers, leading to more unpredictable price effects.

"Consumers rarely see line items for 'tariffs' or 'duties' on their receipts," notes consumer advocate Janet Williams. "But these costs are embedded in the prices they pay, and understanding the difference helps explain why some products face higher price increases than others during trade disputes."

Political and Diplomatic Considerations

In international relations, terminology matters significantly. When a country imposes "tariffs," this signals a trade policy action that may invite retaliation. By contrast, routine "duty" adjustments may be viewed as internal tax matters.

This distinction plays out in media coverage and public perception as well. News headlines about "tariff wars" carry different implications than stories about "duty adjustments."

Looking Ahead: Evolution of the Terminology

As global trade continues to evolve, the distinction between tariffs and duties may shift. New types of border taxes, such as carbon border adjustment mechanisms, don't fit neatly into traditional categories.

"The difference between tariffs and duties will likely become more, not less, important in coming years," predicts Dr. Martinez. "As countries deploy increasingly sophisticated trade tools, understanding these distinctions will be essential for businesses, policymakers, and consumers alike."

Conclusion: Knowledge as Competitive Advantage

For importers, exporters, and companies with global supply chains, recognizing the difference between tariffs and duties represents more than semantic precision—it offers a competitive advantage in navigating the complex landscape of international trade.

As trade policies continue to evolve rapidly, this fundamental distinction will remain essential knowledge for anyone engaged in the global marketplace.

Key Takeaways

- All tariffs are duties, but not all duties are tariffs

- Duties include customs, excise, countervailing, anti-dumping, and safeguard duties

- Tariffs are specifically used as tools of trade policy and negotiation

- Different legal frameworks govern various duties and tariffs

- Understanding these differences offers competitive advantages in global trade

For more detailed information on specific tariff and duty rates, visit the U.S. International Trade Commission's Harmonized Tariff Schedule or consult with a customs broker.

Related Articles

Types of Import Tariffs Explained: Ad Valorem, Specific, Compound, and More

Non-Tariff Barriers: Complete Guide for International Traders

Stay Informed on International Trade Developments

Subscribe to our newsletter for the latest updates on tariffs, duties, and trade policy changes affecting global commerce.

Subscribe to Our Newsletter