U.S. Imposes New Steel and Aluminum Tariffs, EU Responds with Countermeasures

The United States has imposed a 25% tariff on all steel and aluminum imports, including those from the EU, effectively ending the prior tariff-rate quota system and prompting EU countermeasures.

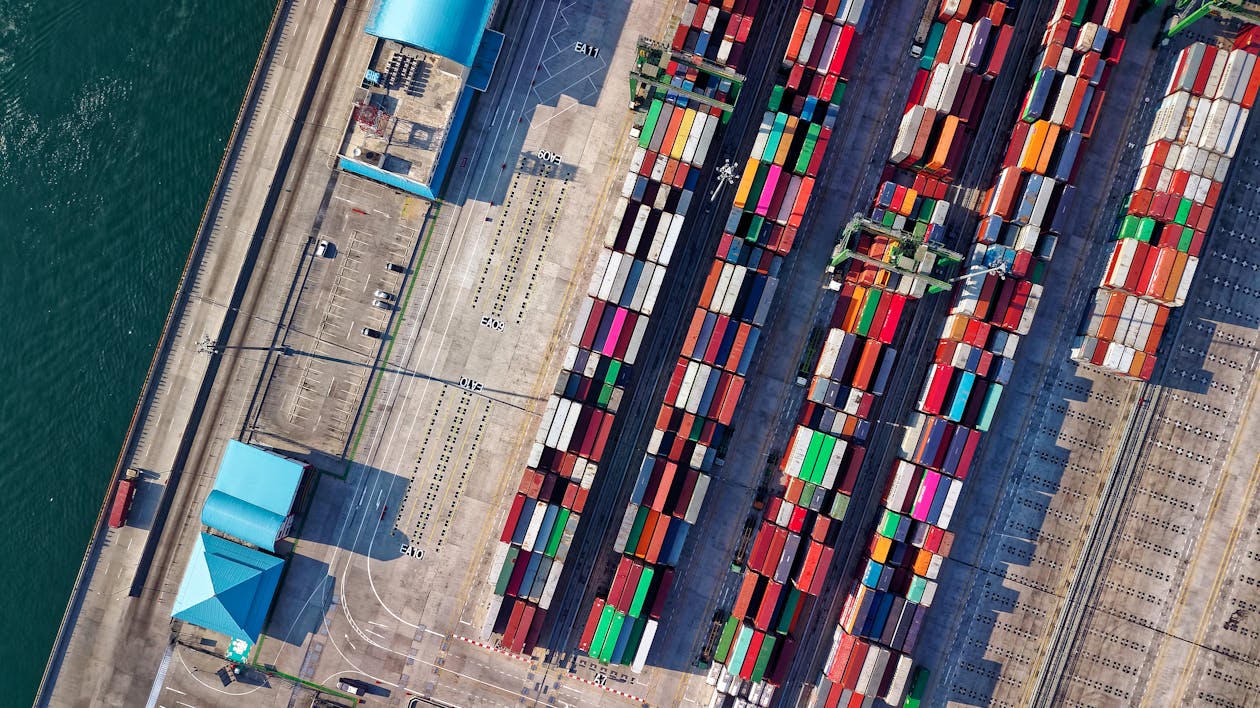

Steel production at a mill in Pennsylvania. The sector has been at the center of escalating trade tensions between the U.S. and EU. Photo: TariffGlossary.com

UPDATED: This article has been updated on April 8, 2025, with the latest developments in the U.S.-EU steel and aluminum tariff dispute. Contrary to earlier reports suggesting an extension of the tariff-rate quota system, recent actions indicate an escalation in trade tensions.

In a significant escalation of trade tensions, the United States imposed a 25% tariff on all steel imports and a 10% tariff on aluminum imports on March 12, 2025, including those from the European Union. This move effectively terminates the tariff-rate quota (TRQ) system that had been in place since 2021 as a resolution to the Section 232 dispute.

The European Union has responded forcefully, with the European Commission proposing counter-tariffs of 25% on a range of U.S. goods on April 7, 2025. These developments mark a substantial deterioration in transatlantic trade relations after a period of relative stability.

The Collapse of the TRQ System

The tariff-rate quota system, originally negotiated in October 2021, had allowed the EU to export up to 3.3 million metric tons of steel and 384,000 metric tons of aluminum to the U.S. duty-free. Exports exceeding these quotas were subject to the Section 232 tariffs of 25% for steel and 10% for aluminum.

The Trump administration's decision to abandon this system came shortly after a presidential memorandum issued on March 10, 2025, which directed a review of all existing tariff exclusions and preference programs with an emphasis on "prioritizing American manufacturers and workers."

"We will no longer accept one-sided deals that undermine the strength of American industry. These tariffs are necessary to ensure the security of our steel and aluminum sectors, which are vital to national defense and critical infrastructure."

— U.S. Trade Representative statement, March 12, 2025

The European Response

Following the U.S. announcement, several key developments have occurred:

- On March 15, 2025, the European Commission called an emergency meeting of trade ministers to formulate a response

- The suspension of EU retaliatory measures, which had been in place since the 2021 agreement, expired on March 31, 2025

- On April 7, 2025, the European Commission formally proposed counter-tariffs of 25% on approximately €6.4 billion ($7.1 billion) of U.S. exports, targeting products ranging from bourbon whiskey and motorcycles to agricultural products and industrial equipment

European Commission Executive Vice President Valdis Dombrovskis described the U.S. action as "unjustified and contrary to World Trade Organization rules," adding that "the EU has no choice but to respond proportionately to protect our commercial interests."

Industry Reactions

The reimposition of tariffs has elicited strong reactions from industry groups on both sides of the Atlantic:

- American Iron and Steel Institute: Welcomed the decision, stating that "these tariffs are essential to combat the ongoing threat of global steel overcapacity and unfair trading practices"

- EUROFER (European Steel Association): Condemned the U.S. action as "a serious blow to EU-U.S. relations" that "unnecessarily disrupts transatlantic supply chains"

- U.S. Chamber of Commerce: Expressed concern that "these tariffs will increase costs for American manufacturers and potentially lead to retaliatory actions that harm U.S. exporters"

- BusinessEurope: Called for "immediate dialogue to prevent a full-scale trade war that would damage economic growth on both sides of the Atlantic"

Global Context and China Factor

Analysts note that the decision to reimpose tariffs on European steel and aluminum comes amid broader concerns about Chinese overcapacity in these sectors. Chinese steel production reached a record 1.1 billion tons in 2024, despite global efforts to address excess capacity.

"The real target here is China, but the EU is caught in the crossfire," explained Dr. Marcus Johnson, senior fellow at the International Trade Policy Institute. "The Trump administration appears to be taking a blanket approach to steel and aluminum imports rather than focusing specifically on the source of overcapacity."

This approach stands in contrast to discussions that had been ongoing as part of the Global Arrangement on Sustainable Steel and Aluminum, which aimed to create differentiated market access based on the carbon intensity of production methods and address non-market practices contributing to overcapacity.

Key Impacts for Businesses

- Immediate 25% tariffs on all EU steel entering the U.S. and 10% on aluminum

- Pending 25% EU tariffs on $7.1 billion of U.S. exports

- Disruption to transatlantic supply chains for steel-consuming industries

- Potential price increases for products containing steel and aluminum

Legal Challenges and WTO Implications

The EU has announced its intention to challenge the U.S. tariffs at the World Trade Organization, reviving a case that had been suspended following the 2021 agreement. This move comes at a complex time for the WTO, which is still working to restore full functionality to its dispute settlement system.

Legal experts note that the original Section 232 justification for these tariffs—national security concerns—remains contentious in international trade law. In a landmark decision in December 2022, the WTO ruled against the United States' Section 232 tariffs on steel and aluminum, finding that they violated global trade rules.

"The U.S. appears to be disregarding the WTO ruling and doubling down on its Section 232 justification," noted Alexandra Rodriguez, professor of international trade law at Georgetown University. "This further undermines the rules-based trading system at a time when it's already under significant strain."

Business Strategies and Adjustments

For companies affected by these developments, trade experts recommend several potential strategies:

- Supply chain diversification: Consider sourcing steel and aluminum from countries not subject to the highest tariffs

- Product exclusion requests: The U.S. Department of Commerce is expected to announce a new exclusion process for specific products not available domestically

- Tariff engineering: Explore whether modifications to products or their classification could mitigate tariff impacts

- Duty drawback: Investigate refund opportunities for duties paid on imported materials used in products that are subsequently exported

"Companies should prepare for a prolonged period of trade uncertainty," advised Maria Chen, Director of Global Trade Compliance at EY. "This isn't likely to be resolved quickly, especially with elections approaching in both the U.S. and several European countries."

Political Dimensions

The timing of these tariffs has raised questions about their political motivations. With U.S. presidential elections scheduled for November 2025, some analysts suggest the move is intended to appeal to voters in steel-producing states like Pennsylvania and Ohio.

European officials have expressed frustration at what they perceive as the politicization of trade policy. "We had established a working relationship based on the 2021 agreement," said one senior EU diplomat speaking on condition of anonymity. "This abrupt change disrupts years of efforts to resolve our differences constructively."

The European counter-tariffs appear strategically targeted at politically sensitive U.S. exports, including products from states that could be decisive in the upcoming election. This approach mirrors the EU's response to the original Section 232 tariffs imposed in 2018.

Diplomatic Efforts and Future Outlook

Despite the escalating tensions, diplomatic channels remain open. European Commission President Ursula von der Leyen and President Trump are scheduled to speak next week, and technical teams from both sides will meet in Washington in late April.

Trade experts are not optimistic about a quick resolution, however. "The fundamental issues that led to the original dispute—overcapacity, subsidies, and divergent views on the appropriate use of trade remedies—remain unresolved," explained Robert Anderson, former WTO official and current advisor at the Peterson Institute for International Economics.

Most analysts predict that the dispute will continue for at least several months, with the potential for further escalation if no progress is made in bilateral discussions. The impact on broader transatlantic cooperation on issues like China's trade practices and technology regulation remains to be seen.

TariffGlossary.com will continue to monitor developments related to the U.S.-EU steel and aluminum dispute and provide updates as the situation evolves. For specific questions about the tariffs or documentation requirements, please refer to our Tariff Schedule Navigator tool, which has been updated with the latest rates.

Related Articles

U.S. Announces New Tariffs on $300 Billion of Chinese Goods

USMCA Review Process to Begin Next Month, Officials Say

Stay Updated on Tariff Developments

Get the latest tariff news, policy updates, and expert analysis delivered directly to your inbox. Join thousands of trade professionals who rely on our insights.

Subscribe to Our Newsletter