Chinese Tariffs on US Goods Explained: The Escalating Trade War of 2025

A comprehensive guide to the unprecedented 125% Chinese tariffs on American exports, their impact on US businesses, and strategic responses for navigating this challenging trade environment.

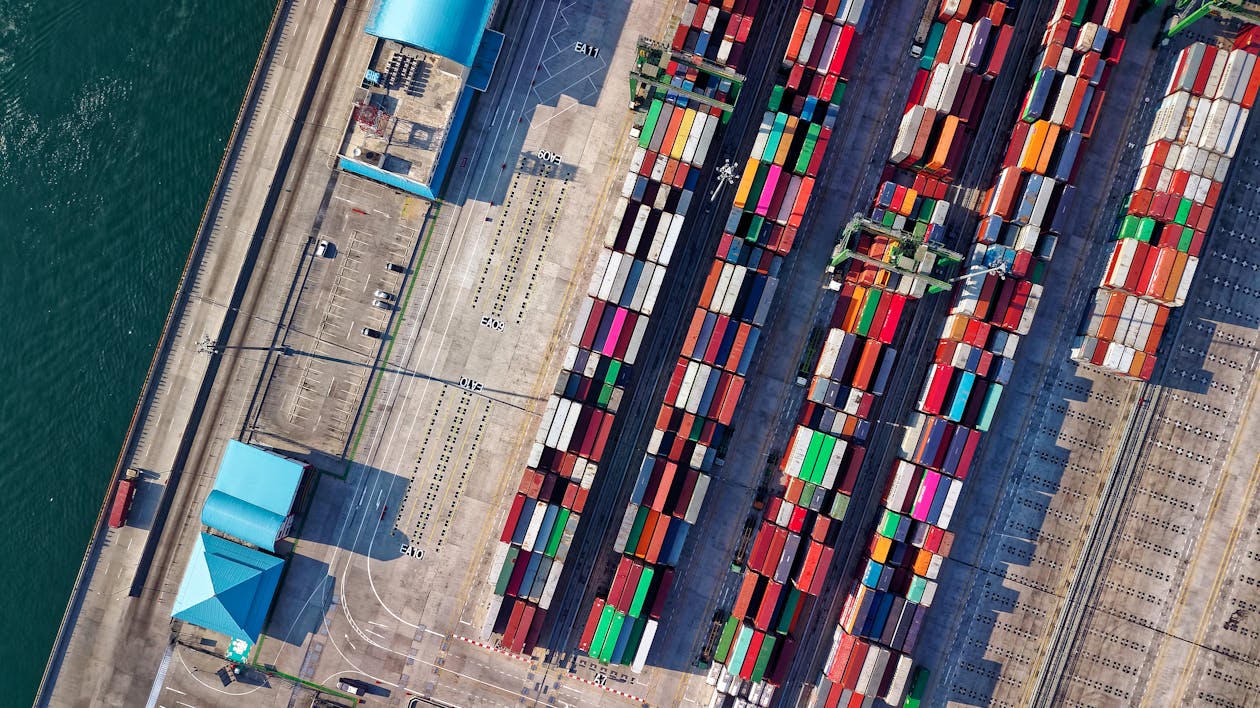

The latest escalation in the US-China trade war has resulted in unprecedented 125% tariffs on US exports to China. Photo: TariffGlossary.com

Last updated: April 25, 2025

The trade relationship between the United States and China has entered a new phase of heightened tensions in 2025, with both countries imposing unprecedented tariff levels on each other's goods. As businesses navigate this challenging landscape, understanding the current state of Chinese tariffs on US exports has become essential for American companies engaged in international trade. This comprehensive guide explains the recent developments, implications, and strategic considerations surrounding Chinese tariffs on US goods.

The Recent Escalation: A Timeline

The current trade tensions have rapidly escalated through a series of retaliatory measures in early 2025:

Chinese Tariffs on US Goods: 2025 Escalation Timeline

TariffGlossary.comInitial US Tariffs

Trump administration imposes 10% "fentanyl IEEPA tariff" on Chinese goods

Initial US Tariffs

Trump administration imposes 10% "fentanyl IEEPA tariff" on Chinese goods

US Increases Tariffs

The US increases tariffs on Chinese goods to 20%

US Increases Tariffs

The US increases tariffs on Chinese goods to 20%

First China Retaliation

China announces first round of retaliatory tariffs, targeting US agricultural exports with 10-15% duties (effective March 10)

First China Retaliation

China announces first round of retaliatory tariffs, targeting US agricultural exports with 10-15% duties (effective March 10)

Major US Escalation

President Trump signs Executive Order 14257, imposing a "reciprocal tariff" regime with a 34% additional tariff on Chinese imports

Major US Escalation

President Trump signs Executive Order 14257, imposing a "reciprocal tariff" regime with a 34% additional tariff on Chinese imports

China Matches US Tariffs

China announces a matching 34% tariff on all US goods while urging the US to "immediately cancel its unilateral tariff measures"

China Matches US Tariffs

China announces a matching 34% tariff on all US goods while urging the US to "immediately cancel its unilateral tariff measures"

US Tariffs Exceed 100%

The US increases tariffs on Chinese goods to 104% (combining previous and new tariffs)

US Tariffs Exceed 100%

The US increases tariffs on Chinese goods to 104% (combining previous and new tariffs)

China Raises to 84%

China raises its retaliatory tariff to 84% with the finance ministry calling the US escalation "a mistake on top of a mistake"

China Raises to 84%

China raises its retaliatory tariff to 84% with the finance ministry calling the US escalation "a mistake on top of a mistake"

China Reaches 125% Tariffs

After US raises tariffs to 125%, China increases tariffs on US goods to matching 125%, effective April 12

China Reaches 125% Tariffs

After US raises tariffs to 125%, China increases tariffs on US goods to matching 125%, effective April 12

Current Status

All US exports to China now face a 125% tariff, regardless of sector

Transitional exemption for goods that departed US ports before April 10, 2025, if imported by May 13, 2025

Beyond Tariffs

- • New export controls on rare earth elements

- • Addition of US companies to "Unreliable Entity List"

- • Anti-trust investigations of US businesses

- • Extension of measures to service sectors

© 2025 TariffGlossary.com

February-March 2025: Initial Tariff Implementation

- February 2025: The Trump administration imposes a 10% "fentanyl IEEPA tariff" on Chinese goods

- March 3, 2025: The US increases this tariff to 20%

- March 4, 2025: China announces its first round of retaliatory tariffs, targeting US agricultural exports with additional duties of 10-15% (effective March 10)

April 2025: Major Escalation

- April 2, 2025: President Trump signs Executive Order 14257, imposing a country-specific "reciprocal tariff" regime with a 34% additional tariff on Chinese imports

- April 4, 2025: China announces a matching 34% tariff on all US goods while urging the US to "immediately cancel its unilateral tariff measures and resolve trade differences through consultation"

- April 9, 2025: The US increases tariffs on Chinese goods to 104% (combining previous and new tariffs)

- April 9, 2025: China raises its retaliatory tariff to 84% with the Chinese finance ministry calling the US escalation "a mistake on top of a mistake"

- April 11, 2025: After the US further raises tariffs to 125%, China increases its tariffs on US goods to 125%, effective April 12 stating that any further US tariff increases would "no longer make economic sense and will become a joke in the history of world economy"

This rapid escalation means that virtually all American exports to China now face a substantial 125% tariff rate, creating significant challenges for US businesses with Chinese customers or operations.

Current Chinese Tariff Structure on US Goods

The current Chinese tariffs on US goods can be broken down as follows:

Universal Application

Unlike some previous targeted tariffs, the current 125% tariff applies universally to all US goods entering China, regardless of sector or product category. This means everything from agricultural products to manufactured goods and consumer items all face the same high duty rate.

Implementation Timing

The 125% tariff took effect on April 12, 2025. However, China has provided a transitional exemption for goods that departed their US port before April 10, 2025, and are imported into China by May 13, 2025. This gives some limited relief for shipments that were already in transit when the latest tariff increase was announced.

Beyond Tariffs: Non-Tariff Measures

In addition to direct tariffs, China has implemented several non-tariff measures that affect US businesses:

- Export Controls: New licensing requirements for crucial rare earth elements needed for electronics, defense systems, and clean energy technologies

- "Unreliable Entity List": Addition of American companies to this list, restricting their ability to conduct business in China

- Anti-trust Investigations: Probes into US companies operating in China

- Service Sector Targeting: Expanding the trade war beyond goods to target the service sector, where the US has historically maintained a significant trade surplus with China

These complementary measures indicate China's multi-pronged approach to responding to US tariffs beyond simple duty rate increases.

Impact on Key US Export Sectors

The 125% tariff rate affects various US export sectors differently, based on their reliance on the Chinese market and the availability of alternative customers.

Impact of 125% Chinese Tariffs by US Export Sector

TariffGlossary.comAgricultural Products

Key Exports Affected

Soybeans, corn, wheat, pork, beef, dairy, fruits, nuts

Impact Level

Market Share Risk

Significant market share loss likely to Brazil (soybeans), Australia (beef), EU (pork)

Price Impact

US producers facing 15-25% price declines due to reduced Chinese demand

Manufacturing

Key Exports Affected

Machinery, aircraft, vehicles, medical devices, specialized equipment

Impact Level

Adaptation Approaches

Supply chain restructuring, production relocation to third countries, joint ventures with Chinese partners

Short-term Response

Halting shipments, absorbing partial costs, negotiating with customers

Technology & Services

Key Exports Affected

Semiconductors, software, cloud services, digital products, specialty tech

Impact Level

Compounding Factors

Export controls, rare earth minerals restrictions, intellectual property concerns

Market Alternatives

Accelerated development of alternative Asian markets, domestic focus

Annual US Exports to China by Sector (Pre-tariff)

Source: US-China Business Council, US Department of Commerce data, 2025 | © TariffGlossary.com

Agricultural Products

American agricultural exports have been particularly hard hit, with products like soybeans, corn, wheat, pork, and beef facing substantial challenges. Prior to the trade war, China was a major market for US agricultural products, with soybeans alone accounting for a significant portion of US agricultural exports to China.

The latest tariffs make US agricultural goods substantially more expensive for Chinese buyers, likely leading to:

- Reduced market share in China

- Price pressure from competing exporters like Brazil (soybeans) and Australia (beef)

- Potential long-term loss of established trade relationships

Manufacturing and Technology

US manufacturers exporting to China face difficult decisions about whether to:

- Absorb the tariff costs to maintain market share

- Pass costs to Chinese customers (potentially losing business)

- Relocate production to non-US locations to avoid tariffs

For technology companies, the combined effect of tariffs and export controls creates a particularly challenging environment. Chinese restrictions on rare earth minerals also threaten supply chains for US tech manufacturing.

Consumer Goods

American consumer brands with Chinese markets face steep challenges as their products become significantly more expensive for Chinese consumers. Luxury goods, in particular, may see decreased demand as price-sensitive consumers switch to alternatives from non-US sources.

Strategic Responses by US Companies

American businesses are developing various strategies to navigate the high Chinese tariffs:

Supply Chain Restructuring

Some companies are relocating production or sourcing components from countries not subject to Chinese tariffs. However, this strategy has become more complex as the US has also imposed tariffs on many alternative manufacturing hubs like Vietnam, Mexico, and Malaysia.

Market Diversification

US exporters are increasingly looking to reduce their reliance on the Chinese market by expanding sales to other Asian countries, Europe, and emerging markets. This strategy requires significant investment in developing new customer relationships and adapting products to different market requirements.

Joint Ventures and Local Production

Some US companies are exploring joint ventures with Chinese partners or establishing production facilities within China to avoid tariffs. This approach has regulatory complexities but may be viable for companies with a long-term commitment to the Chinese market.

Duty Management Strategies

Companies are also exploring legal mechanisms to minimize duty impacts, such as:

- Utilizing bonded warehouses in China

- Exploring whether their products qualify for any exemptions

- Adjusting product specifications or classifications

Economic Implications

The unprecedented level of mutual tariffs between the world's two largest economies has significant implications:

For China

- Potential job losses in export-oriented manufacturing

- Pressure on economic growth already strained by property sector issues

- Higher costs for Chinese manufacturers using US components

- Accelerated efforts to reduce dependency on US technology

For the US Economy

- Reduced exports to China, affecting businesses and agricultural producers

- Higher consumer prices for Chinese-made goods

- Supply chain disruptions across multiple industries

- Increased economic uncertainty affecting investment decisions

Global Economic Impact

- Disruption of integrated global supply chains

- Stock market volatility and investment uncertainty

- Concerns about global growth, with JP Morgan estimating a 60% chance of a global recession by the end of 2025

- Pressure on other countries to choose sides in the economic conflict

Outlook and Future Scenarios

The future trajectory of Chinese tariffs on US goods remains uncertain, with several possible scenarios:

Scenario 1: Continued Escalation

Further escalation seems less likely given both sides have reached extremely high tariff levels. However, the conflict could intensify through:

- Expansion of non-tariff barriers

- Targeting of specific US companies operating in China

- Restrictions on services and investment

Scenario 2: Negotiated De-escalation

A negotiated reduction in tariffs remains possible, particularly as economic pressures mount on both sides. This might include:

- Gradual tariff reductions in exchange for specific concessions

- Sector-by-sector agreements to normalize trade

- Maintenance of some tariffs while removing others

Scenario 3: Extended Standoff

The most likely near-term scenario may be a prolonged period of high tariffs with:

- Both sides maintaining current tariff levels

- Businesses adapting to the new reality through supply chain adjustments

- Gradual decoupling of the US and Chinese economies in sensitive sectors

Practical Considerations for US Exporters

For US businesses currently exporting to China or considering entering the market, several practical steps are worth considering:

Action Plan for US Exporters

Immediate Actions

- Review current contracts with Chinese partners for force majeure provisions

- Calculate the exact impact of the 125% tariff on your pricing and profitability

- Communicate transparently with Chinese customers about pricing implications

- Explore temporary suspension of shipments until greater clarity emerges

Medium-Term Strategies

- Evaluate the viability of local production in China or neighboring countries

- Reassess market strategy and potential partnerships to maintain presence

- Explore alternative markets to diversify export destinations

- Monitor diplomatic developments for signs of potential negotiation

Long-Term Planning

- Develop contingency plans for various scenarios (continued conflict vs. resolution)

- Consider structural changes to your supply chain to reduce vulnerability

- Evaluate investment in innovation to maintain competitive advantage regardless of tariffs

- Maintain relationships in China even if current business is reduced

Conclusion

The current 125% Chinese tariffs on US goods represent an extraordinary level of trade restriction that significantly challenges the traditional US-China economic relationship. While the situation remains fluid, American businesses must adapt to this new reality while remaining flexible enough to respond to future changes.

Understanding these tariffs—their structure, impact, and potential evolution—is essential for making informed business decisions in an increasingly complex global trade environment. By developing strategic responses and contingency plans, US exporters can navigate these challenges while positioning themselves for long-term success regardless of how US-China trade relations evolve.

This article is for informational purposes only and does not constitute legal, tax, or business advice. Given the rapidly changing nature of international trade policy, we recommend consulting with qualified professionals regarding specific situations.

Want to learn more about tariffs and international trade? Explore our other resources at tariffglossary.com.

Related Articles

How to Read HS Codes: Complete Guide for Importers & Exporters

Section 301 Tariffs Simplified: Understanding Their Impact in 2025

Stay Informed on US-China Trade Relations

Subscribe to our newsletter for the latest updates on tariff developments, policy changes, and expert analysis of their impact on international trade.

Subscribe to Our Newsletter