Section 301 Tariffs Simplified: Understanding Their Impact in 2025

A comprehensive guide to Section 301 tariffs, recent policy developments, and strategic considerations for businesses navigating the evolving U.S.-China trade relationship.

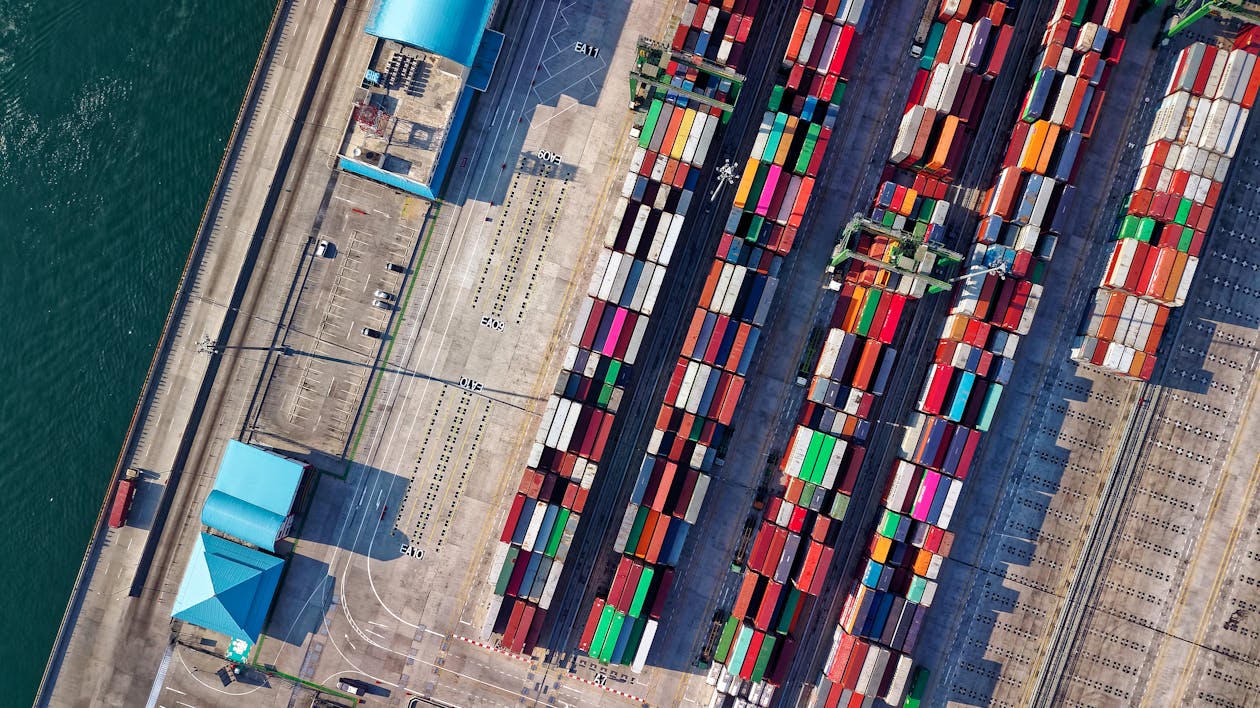

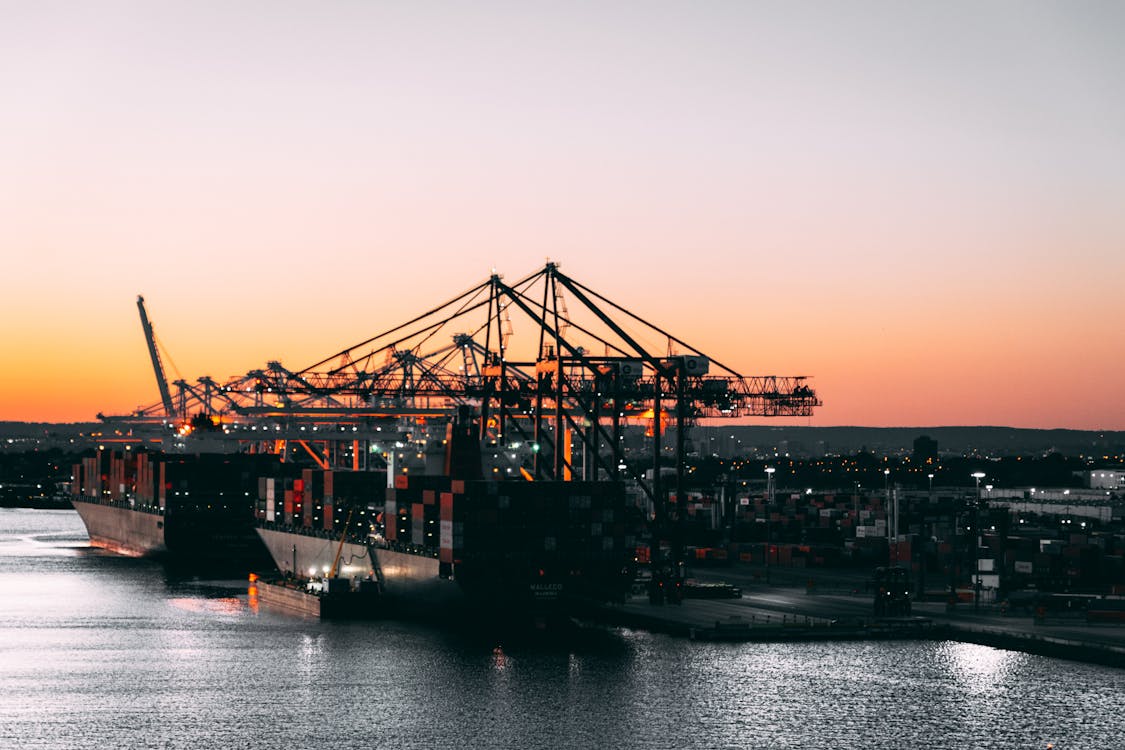

Section 301 tariffs have dramatically reshaped global supply chains and trade patterns since their introduction in 2018. Photo: TariffGlossary.com

Last updated: April 20, 2025

What Are Section 301 Tariffs?

Section 301 tariffs are import duties imposed by the United States based on Section 301 of the Trade Act of 1974. This law gives the U.S. Trade Representative (USTR) authority to investigate and respond to foreign trade practices that are deemed unfair or that burden U.S. commerce.

In simple terms, these tariffs are a trade policy tool the U.S. government uses when it believes another country is engaging in unfair trade practices.

The China Connection: Why Section 301 Matters Now

When most people talk about "Section 301 tariffs" today, they're typically referring to the tariffs imposed on goods imported from China. These tariffs began in 2018 during the first Trump administration after an investigation determined that China's practices related to technology transfer, intellectual property, and innovation were unreasonable and discriminatory.

These tariffs have evolved significantly over time, and with President Trump's return to office in 2025, they've undergone further dramatic changes as part of his broader trade policy.

Section 301 Tariff Lists Explained

TariffGlossary.comList 1

Effective Date: July 6, 2018

Value: $34 billion in Chinese goods

Tariff Rate: 25%

Primary Sectors: Industrial equipment, machinery, medical devices, and high-tech components

List 2

Effective Date: August 23, 2018

Value: $16 billion in Chinese goods

Tariff Rate: 25%

Primary Sectors: Semiconductors, plastics, motors, railway components, and chemical products

List 3

Initial Effective Date: September 24, 2018

Value: $200 billion in Chinese goods

Original Rate: 10%

Rate Increase: 25% (May 10, 2019)

Primary Sectors: Broad range including textiles, food, metals, consumer electronics

List 4A

Initial Effective Date: September 1, 2019

Value: $120 billion in Chinese goods

Original Rate: 15%

Rate Change: Reduced to 7.5% (February 14, 2020)

Primary Sectors: Consumer goods, clothing, food items

These lists have been significantly impacted by the April 2025 changes, with tariffs now at 125% for Chinese goods

© 2025 TariffGlossary.com

How Section 301 Tariffs Are Structured

The Section 301 tariffs on China were originally implemented in four main waves or "lists":

- List 1: Covered $34 billion in Chinese goods, effective July 6, 2018

- List 2: Covered $16 billion in Chinese goods, effective August 23, 2018

- List 3: Covered $200 billion in Chinese goods, effective September 24, 2018

- List 4A: Covered $120 billion in Chinese goods, effective September 1, 2019

Before recent changes, these tariffs ranged from 7.5% to 25% on a wide variety of Chinese imports.

Recent Developments Under the Trump Administration (2025)

The Section 301 tariff landscape has changed dramatically in 2025, with several key developments:

1. New Executive Orders

On February 1, 2025, President Trump signed an executive order imposing an additional 10% ad valorem duty on imports from China, on top of the existing Section 301 duties. This increased to 20% on March 4, 2025, with the administration citing dissatisfaction with China's efforts to control the flow of illegal substances, including fentanyl, into the United States.

2. April 2025 "Reciprocal Tariffs" Framework

In a sweeping move that affects not just China but global trade broadly, President Trump signed an executive order on April 2, 2025, implementing a "reciprocal tariffs" framework. This action:

- Imposed a baseline 10% tariff on imports from nearly all countries (effective April 5)

- Established individualized higher tariff rates for major trading partners

- Declared a national emergency related to trade deficits, invoking authorities under the International Emergency Economic Powers Act (IEEPA)

3. China-Specific Actions (April 9, 2025)

On April 9, 2025, the administration made another major announcement:

- Paused most of the new reciprocal tariffs for 90 days to allow for negotiations with trading partners

- Dramatically increased the tariff rate on Chinese imports to 125%

- This came in response to China's announced 34% retaliatory tariff on all U.S. goods, which China then increased to 84%

"The 125% tariff rate on Chinese imports represents the most significant escalation in U.S.-China trade tensions since the trade war began in 2018. Businesses should prepare for prolonged supply chain disruption and significant cost increases."

— Dr. Michael Chen, International Trade Economist, Georgetown University2025 Tariff Timeline: Key Dates

TariffGlossary.comAdditional 10% duty on Chinese imports imposed via executive order

Tariff on Chinese goods increased to 20% due to fentanyl concerns

Tariff on Chinese goods increased to 20% due to fentanyl concerns

"Reciprocal tariffs" framework announced with 10% baseline on all imports

10% baseline tariff implemented across most trading partners

10% baseline tariff implemented across most trading partners

Chinese tariffs increased to 125%; other countries' tariffs paused for 90 days

© 2025 TariffGlossary.com

Product-Specific Changes and Exclusions

Beyond the broad tariff increases, there have been targeted changes affecting specific product categories:

- Critical Sectors: The Biden administration initiated tariff increases on strategic sectors in September 2024, including electric vehicles, semiconductors, and critical minerals, with scheduled increases in 2025 and 2026.

- New Exclusion Process: A limited new exclusion process has been established for manufacturing machinery in specific tariff lines in Chapters 84 and 85 of the Harmonized Tariff Schedule, with a deadline of March 31, 2025, for submissions.

- Existing Exclusions: The 164 exclusions that were granted in 2022 and extended are set to expire on May 31, 2025, unless further extended.

De Minimis Shipments (Small-Value Imports)

An important element of the Section 301 framework concerns de minimis shipments—small-value shipments that are typically exempt from duties under the $800 threshold granted by U.S. law.

Recent developments include:

- Initially, the February 2025 executive order suspended de minimis treatment for shipments from China

- This was temporarily lifted on February 7 to address implementation challenges

- On April 9, 2025, further changes were announced, increasing duties on de minimis shipments from China to ensure the tariffs aren't circumvented through small-value shipments

Key Facts: Section 301 Impact

TariffGlossary.com- Combined with other duties, Chinese goods now face up to 150% effective tariff rates

- U.S.-China trade decreased by 32% in Q1 2025 compared to Q1 2024

- Over 47,000 U.S. companies filed for Section 301 exclusions since 2018

- Average cost increase of $1,850 per U.S. household in 2025 due to Section 301 and related tariffs

- Only 12% of exclusion requests have been approved since the program began

How Section 301 Tariffs Impact Your Business

Section 301 Business Impact

TariffGlossary.comIf You Import from China

- 1

Higher Import Costs

The 125% Section 301 tariffs dramatically increase your importing costs

- 2

Supply Chain Decisions

Many businesses are reconsidering sourcing from non-Chinese suppliers

- 3

Exclusion Opportunities

Limited exclusion processes for machinery in HTS Chapters 84-85

- 4

Cash Flow Challenges

Higher tariffs mean more capital tied up in customs duties

If You Export to China

- 1

Retaliatory Tariffs

China's 84% retaliatory tariffs make your products more expensive

- 2

Competitive Disadvantage

Your products face higher prices compared to non-US competitors

- 3

Market Access Challenges

Trade tensions create additional barriers beyond direct tariff costs

- 4

Customer Relationships

Chinese buyers may seek alternative suppliers from lower-tariff countries

© 2025 TariffGlossary.com

If You Import from China

If your business imports goods from China, these tariffs have a direct impact on your costs:

- Higher Import Costs: The combination of existing Section 301 duties and the new 125% reciprocal tariff significantly increases the cost of importing Chinese goods.

- Supply Chain Decisions: Many businesses are reevaluating their supply chains, considering sourcing from countries not subject to these high tariffs.

- Exclusion Opportunities: If you import manufacturing machinery that falls under the limited exclusion process, you may want to investigate applying for an exclusion.

- Cash Flow Considerations: Higher tariffs mean more capital tied up in customs duties, which could affect your cash flow.

If You Export to China

American businesses exporting to China also face challenges due to China's retaliatory tariffs:

- Higher Costs for Chinese Buyers: China's retaliatory tariffs (now at 84%) make American goods more expensive for Chinese customers.

- Competitive Disadvantage: American products may be at a price disadvantage compared to similar products from countries not subject to these retaliatory tariffs.

- Market Access Challenges: Beyond direct tariff costs, ongoing trade tensions may create additional barriers to market access in China.

Key Industries Affected

While Section 301 tariffs affect a broad range of goods, several industries are particularly impacted:

- Electronics and Consumer Technology: Components, finished products, and manufacturing equipment

- Manufacturing Equipment and Machinery: Now subject to high tariffs, though with potential exclusion opportunities

- Medical Supplies: Including various medical equipment and supplies

- Automotive: Parts and components used in vehicle manufacturing

- Solar and Renewable Energy: Panels, components, and related products

Planning Your Business Strategy

Given the current high-tariff environment, businesses should consider:

- Diversifying Supply Chains: Reducing reliance on Chinese manufacturing where feasible.

- Tariff Engineering: Exploring whether product modifications could result in different classification and potentially lower duties.

- Customs Planning: Working with customs experts to ensure correct classification and valuation of goods.

- Exploring Duty Deferral Programs: Investigating foreign trade zones, bonded warehouses, and other programs that might provide duty management benefits.

- Monitoring Developments: Staying informed about policy changes, as the trade situation continues to evolve rapidly.

Conclusion

Section 301 tariffs, particularly as they apply to China, have become increasingly complex and significant since their introduction in 2018. With the dramatic escalation in 2025, understanding these tariffs is more important than ever for businesses engaged in international trade.

While the current high-tariff environment creates challenges, it also emphasizes the importance of strategic planning, supply chain resilience, and staying informed about policy developments.

This article is for informational purposes only and does not constitute legal, tax, or customs advice. For specific guidance regarding your situation, consult with qualified professionals.

Related Articles

Trade Wars Reignited: Understanding Global Tariff Escalation

Types of Import Tariffs Explained: A Comprehensive Guide

Check Your Section 301 Exclusion Eligibility

Use our free Section 301 Exclusion Checker tool to see if your products might qualify for tariff exclusions or reductions.

Try the Exclusion Checker