Trade Wars Reignited: Understanding the New Era of Global Tariffs

The global economic landscape has been dramatically reshaped in recent weeks as President Trump's sweeping tariff policy has sent shockwaves through international markets and diplomatic channels.

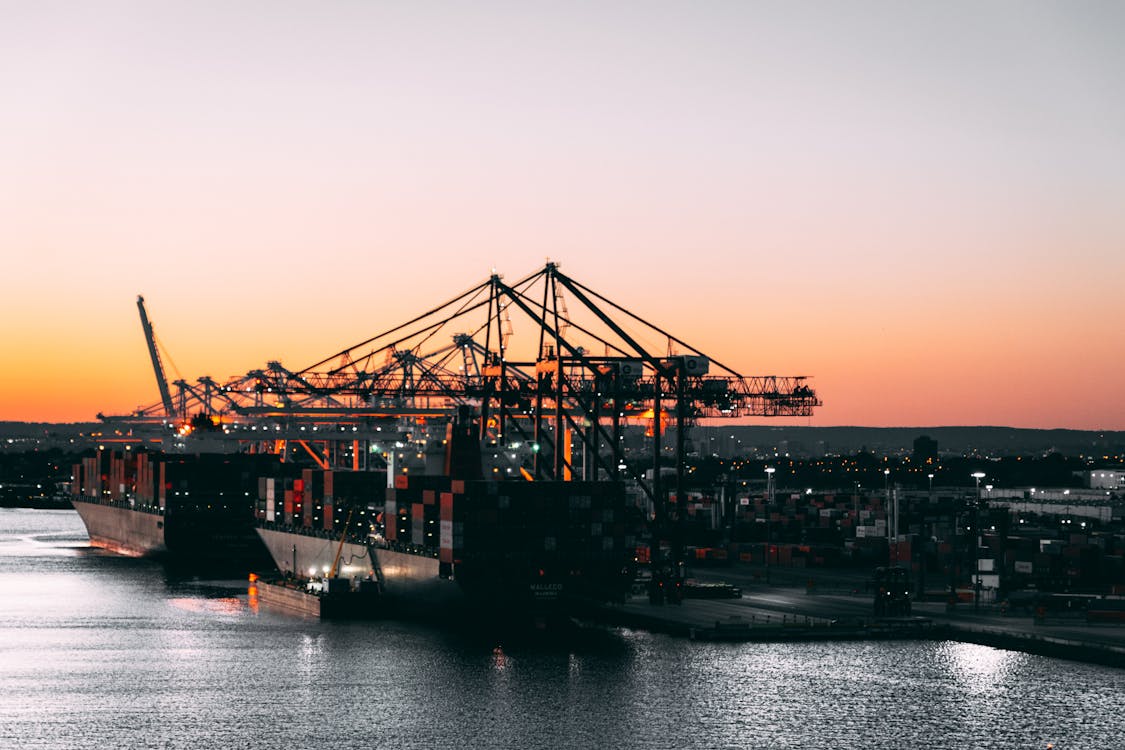

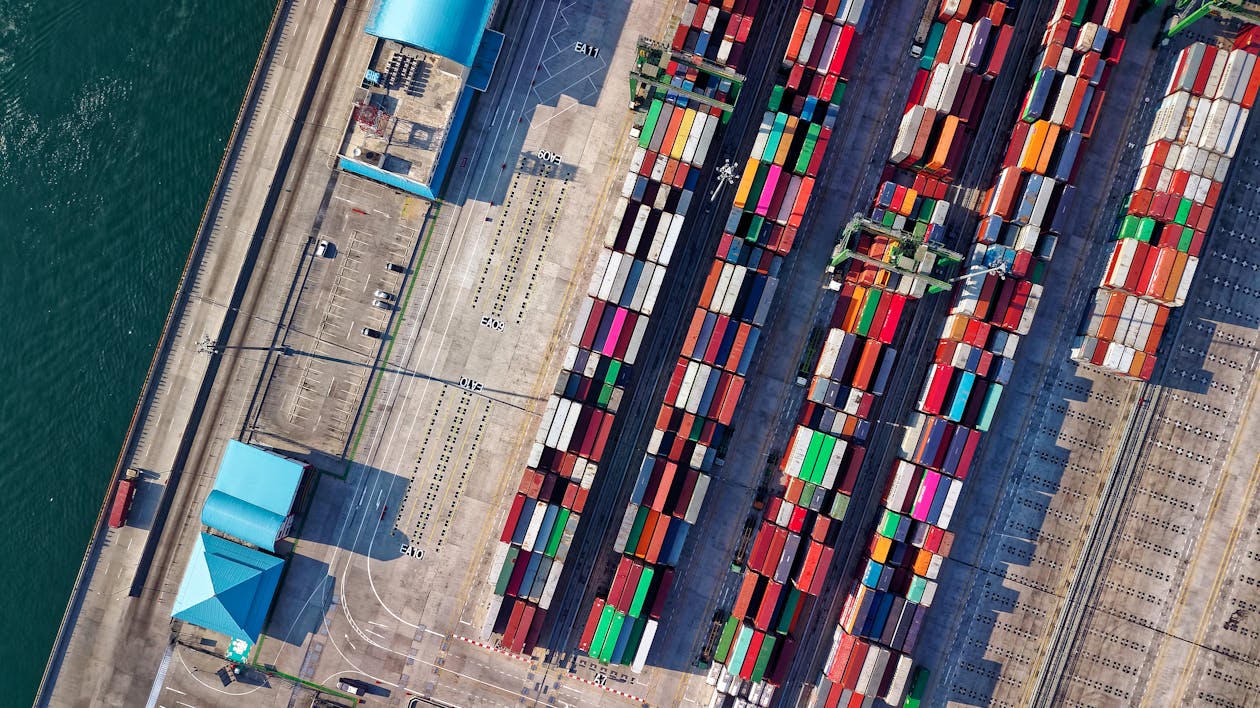

Global supply chains face unprecedented disruption as new tariffs take effect. Photo: TariffGlossary.com

The global economic landscape has been dramatically reshaped in recent weeks as President Trump's sweeping tariff policy has sent shockwaves through international markets and diplomatic channels. What began as campaign promises has transformed into the most significant shift in U.S. trade policy in nearly a century, with potential long-term consequences for consumers, businesses, and the global economy.

The New Tariff Regime: What's Actually Happening

On April 2, 2025, President Trump declared a national emergency regarding the U.S. trade deficit, invoking his authority under the International Emergency Economic Powers Act (IEEPA) to implement a radical new tariff structure. The plan consists of two tiers:

- A baseline 10% tariff on all imports from all countries, which took effect on April 5

- Higher "reciprocal" tariffs (ranging from 10-50%) on 57 major trading partners, scheduled to begin April 9

In announcing these measures, the Trump administration has characterized them as a necessary correction to "non-reciprocal trade arrangements" that have disadvantaged American workers and businesses. However, the international response has been swift and largely negative.

Breaking Update

Earlier today, the White House confirmed that the second tier of "reciprocal" tariffs will proceed as scheduled on April 9, despite emergency diplomatic efforts from multiple countries. Companies importing goods from the 57 affected nations should prepare for immediate cost increases.

Global Fallout: A Trade War in the Making

The market reaction has been severe. Global stock markets experienced their worst sell-off since the pandemic, with the Dow falling nearly 4% and the tech-heavy Nasdaq plunging nearly 6% in a single day. Major U.S. companies with significant overseas production have been hit particularly hard – Nike shares lost 14% and Apple fell 9%.

Countries around the world are preparing various responses:

- European Union: Has announced retaliatory measures in two stages: reimposing $4.9 billion in tariffs from April 1, with an additional $19 billion in new tariffs planned for April 13

- Canada: Initially responded aggressively, with Ontario Premier Doug Ford imposing 25% retaliatory tariffs on electricity exports to Minnesota, Michigan, and New York

- Mexico: Has suspended plans for retaliatory tariffs, suggesting potential negotiations

- Japan: Prime Minister called the situation a "national crisis" as their stock market suffered its worst week in years

Perhaps most concerning for economic observers is that investment bank JP Morgan has raised its forecast for a global recession by year's end from 40% to 60%.

"The tariffs give us great power to negotiate. Always have. I used it very well in the first administration, as you saw, but now we're taking it to a whole new level."

— President Donald Trump, April 3, 2025

The Economic Logic (and Potential Fallacies)

The Trump administration argues that tariffs serve as negotiating leverage and will ultimately lead to more favorable trade terms for American producers. However, many economists and trade experts have raised serious concerns about this approach:

Consumer Impact

Tariffs function as taxes that are ultimately paid by domestic consumers through higher prices, not foreign countries. The Tax Foundation estimates the average American household will face $2,500 in additional costs annually.

Supply Chain Disruption

Modern manufacturing relies on global supply chains that can't be rewired overnight. Companies like Ford and General Motors are already warning of production slowdowns due to parts shortages.

Retaliation Risk

Trading partners rarely accept tariffs without implementing their own countermeasures. The spiral of retaliation can quickly escalate, as seen in the already announced EU measures targeting U.S. agricultural and industrial products.

Growth Impact

According to the Tax Foundation, Trump's tariffs will raise nearly $2.9 trillion in revenue over the next decade but reduce U.S. GDP by 0.7% even before accounting for foreign retaliation.

Key Facts: The Scale of Change

- Average U.S. tariff rate will rise from 2.5% in 2024 to 16.5% – highest since 1937

- Over $2.9 trillion in new tariff revenue projected over the next decade

- 57 countries facing additional "reciprocal" tariffs beyond the baseline 10%

- Nearly $24 billion in retaliatory tariffs announced by the EU alone

Historical Context and Future Outlook

What makes this moment particularly significant is the scale and breadth of the new tariffs. The average tariff rate on all U.S. imports will rise from 2.5% in 2024 to 16.5% – the highest average rate since 1937. This marks a dramatic reversal of the post-World War II consensus that gradually reduced trade barriers globally.

"This is the single biggest trade action of our lifetime... This is a pretty seismic and significant shift in the way that we trade with every country on earth."

— Kelly Ann Shaw, former White House trade adviser during Trump's first term

Where do we go from here? The next few weeks will be critical as countries decide how aggressively to retaliate. Much will depend on whether the Trump administration views these tariffs as a permanent policy shift or as leverage for negotiating new bilateral trade deals.

The only certainty is uncertainty – businesses must now navigate a world where longstanding trade relationships and supply chains are suddenly in flux. For everyday consumers, the reality may soon hit home in the form of higher prices for everything from electronics to automobiles to household goods.

In this new era of protectionism, the only predictable element may be unpredictability itself.

Business Response Strategies

For businesses grappling with the new tariff landscape, trade experts recommend several potential strategies:

- Supply chain diversification: Consider shifting production or sourcing to countries facing lower tariff rates

- Tariff engineering: Review product classifications to determine if modifications could result in more favorable tariff treatment

- Foreign Trade Zones: Utilize FTZ benefits to defer, reduce, or eliminate duties on imports

- Trade remedy proceedings: Consider requesting product-specific exclusions once the Department of Commerce establishes an exclusion process

- Pricing strategies: Develop contingency plans for absorbing tariff costs versus passing them to customers

According to Maria Gonzalez, Director of International Trade at Deloitte, "Companies need to conduct immediate tariff impact assessments and develop multi-scenario planning. Those that take a wait-and-see approach could find themselves at a significant competitive disadvantage."

TariffGlossary.com will continue to monitor this rapidly evolving situation. For assistance understanding how these tariffs might affect your specific imports or for help with tariff classification, please refer to our Duty Calculator and HTS Code Lookup tools.

This article represents our analysis of current events and should not be construed as financial advice.

Related Articles

U.S. Imposes New Steel and Aluminum Tariffs, EU Responds

U.S. Announces New Tariffs on $300 Billion of Chinese Goods

Stay Updated on Tariff Developments

Get the latest tariff news, policy updates, and expert analysis delivered directly to your inbox. Join thousands of trade professionals who rely on our insights.

Subscribe to Our Newsletter