What Is a Reciprocal Tariff? Definition, History, and Current Policy

A comprehensive guide explaining what reciprocal tariffs are, how they're calculated, their economic impact, and what businesses can do to navigate this evolving trade policy.

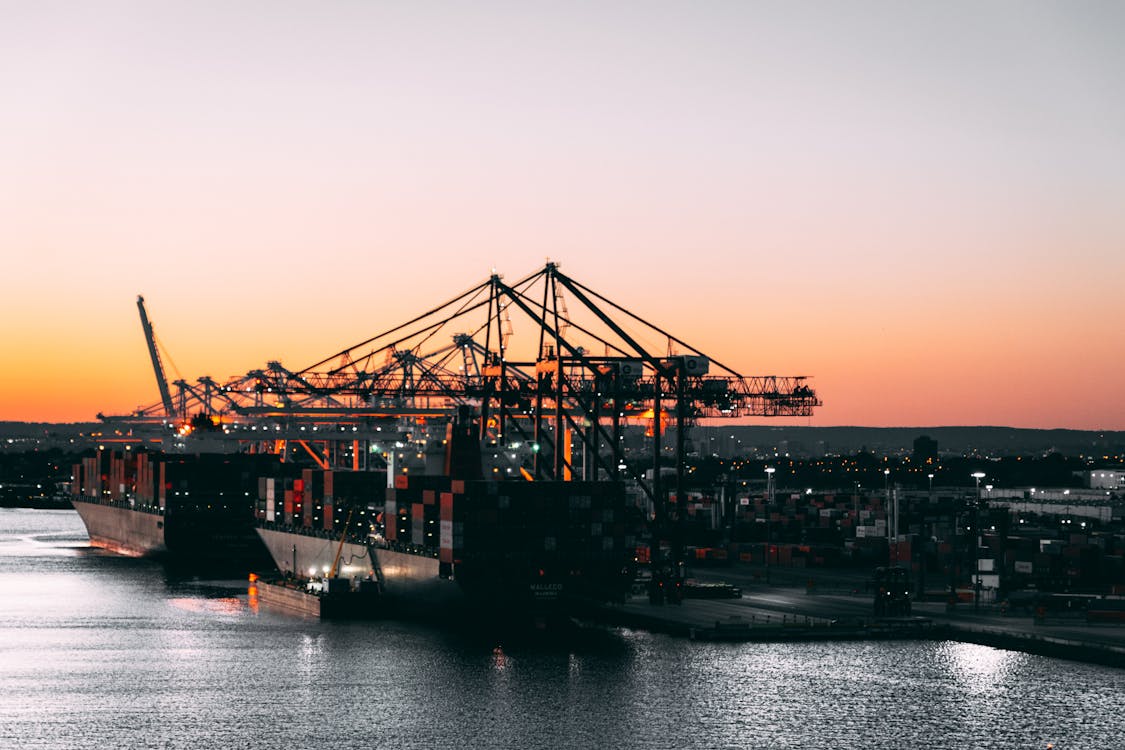

Reciprocal tariffs have dramatically reshaped global trade patterns and supply chains since their introduction in 2025. Photo: TariffGlossary.com

Last updated: April 22, 2025

In today's global trade landscape, "reciprocal tariffs" have become one of the most discussed and debated trade policy tools. But what exactly is a reciprocal tariff, how does it work, and what impacts does it have on businesses and consumers? This comprehensive guide explains everything you need to know about this important trade concept.

Definition of a Reciprocal Tariff

A reciprocal tariff is an import duty imposed by one country in direct response to, or to match, the tariff rates charged by its trading partners. The basic concept is simple: if Country A charges a 20% tariff on specific goods from Country B, then Country B would impose a similar 20% tariff on the same or comparable goods from Country A.

In its simplest form, as defined by President Trump, a reciprocal tariff means that "if they tax us, we tax them the same amount." The fundamental idea is to create tariff parity between trading partners.

What is a Reciprocal Tariff?

TariffGlossary.comBasic Principle

"If they tax us, we tax them the same amount"

Primary Goal

Create tariff parity between trading partners

Policy Focus

Address trade imbalances & perceived unfair practices

Simple Example of a Reciprocal Tariff

Country A

Charges 20% tariff on electronics from Country B

Result

Country B imposes matching 20% tariff on electronics from Country A

Modern Approach

Considers multiple factors beyond simple tariff rates:

- Existing tariff levels

- Non-tariff barriers

- Tax system differences

- Currency valuation

A reciprocal tariff aims to create a level playing field in international trade by matching import duties between trading partners

© 2025 TariffGlossary.com

Historical Context of Reciprocal Tariffs

The concept of reciprocity in trade policy isn't new in American history. The Reciprocal Trade Agreements Act (RTAA) of 1934 marked a significant shift in how the United States approached international trade during the Great Depression.

The RTAA gave the president power to negotiate bilateral, reciprocal trade agreements with other countries and enabled Roosevelt to liberalize American trade policy. It is widely credited with ushering in the era of liberal trade policy that persisted throughout the 20th century.

During this historical period, reciprocity was used primarily as a tool for mutual tariff reduction rather than tariff escalation. Between 1934 and 1945, the executive branch negotiated and signed 32 bilateral reciprocal trade agreements designed to lower tariff rates on a reciprocal basis. This approach helped move global trade toward a more liberalized system after the protectionist era of the 1920s and early 1930s.

Current Concept of Reciprocal Tariffs

The modern interpretation of reciprocal tariffs, particularly in the context of recent U.S. trade policy, differs somewhat from its historical usage. Today's approach is less about mutual reduction and more about equalizing perceived imbalances in tariff rates between countries.

The current approach to reciprocal tariffs is based on the following principles:

- Addressing trade deficits: The policy aims to reduce persistent trade deficits by equalizing tariff rates.

- Countering perceived unfair practices: Reciprocal tariffs target not just direct tariff imbalances but also what are viewed as non-reciprocal trade arrangements.

- Comprehensive scope: The policy examines trade relationships with all trading partners, not just specific countries or industries.

How Reciprocal Tariffs Are Calculated

Determining truly "reciprocal" tariff rates is complex. According to recent policy developments, the calculation of reciprocal tariffs considers multiple factors:

- Existing tariff rates on U.S. exports to other countries

- Non-tariff barriers that impede U.S. exports

- Value-added taxes and other tax systems that differ from the U.S. system

- Currency valuation policies that may create trade advantages

- Other practices that may create trade imbalances

The comprehensive nature of these calculations makes determining truly "reciprocal" rates challenging. Critics have pointed out that this approach "does not reflect reciprocity as applied in past multilateral trade negotiations or in equality of tariffs."

Recent Implementation of Reciprocal Tariffs (2025)

2025 Reciprocal Tariff Implementation

TariffGlossary.comExecutive Order announcing "Reciprocal Tariffs Framework" signed

10% baseline reciprocal tariff implemented on imports from most countries

10% baseline reciprocal tariff implemented on imports from most countries

90-day pause announced for most countries to allow for negotiations

China-specific exception: Reciprocal tariff rate increased to 125% following Chinese retaliation

China-specific exception: Reciprocal tariff rate increased to 125% following Chinese retaliation

Key Components

- • Baseline 10% tariff on nearly all countries

- • Country-specific rates from 11-50%

- • 90-day negotiation window

- • China-specific 125% rate

Product Exemptions

- • Products with Section 232 steel/aluminum tariffs

- • Certain automotive products

- • Specified medical supplies

- • Various critical raw materials

© 2025 TariffGlossary.com

In April 2025, the United States implemented a new reciprocal tariff framework through a series of executive orders. The implementation included:

- Baseline tariff: A 10% tariff on imports from nearly all countries, effective April 5, 2025.

- Country-specific rates: Higher individualized tariff rates for countries with which the U.S. has significant trade deficits, ranging from 11% to 50%, initially scheduled for April 9, 2025.

- Pause and exception: On April 9, the administration announced a 90-day pause on these country-specific rates for most countries to allow for negotiations, with the notable exception of China.

- China-specific action: The reciprocal tariff rate for Chinese imports was raised to 125% following China's announcement of retaliatory tariffs.

- Exemptions: Certain product categories are exempt from these reciprocal tariffs, including products subject to existing steel and aluminum tariffs under Section 232, automotive products subject to separate tariffs, and certain other specific product categories.

How Reciprocal Tariffs Differ from Other Types of Tariffs

Comparing Tariff Types

TariffGlossary.comReciprocal Tariffs

Primary Purpose: Create tariff parity between trading partners

Target: Overall trade relationships with specific countries

Calculation: Based on perceived imbalances in broader trade relationship

Policy Goal: Address trade deficits and negotiate better terms

Example: 2025 reciprocal tariff framework with 10% baseline

Protective Tariffs

Primary Purpose: Shield domestic industries from foreign competition

Target: Specific products or industries regardless of origin

Calculation: Based on protecting domestic industry's interests

Policy Goal: Preserve domestic jobs and industries

Example: 25% tariffs on imported steel and aluminum (Section 232)

Retaliatory Tariffs

Primary Purpose: Counter specific trade actions by another country

Target: Politically sensitive products from specific country

Calculation: Based on political impact and response proportionality

Policy Goal: Apply pressure to change another country's policy

Example: EU tariffs on U.S. bourbon and motorcycles in response to steel tariffs

Revenue Tariffs

Primary Purpose: Generate funds for government operations

Target: Goods with reliable import volumes and limited substitutes

Calculation: Based on revenue generation potential

Policy Goal: Fiscal policy and government funding

Example: Historical tariffs on luxury goods or alcohol

While these tariff types have distinct purposes, real-world tariffs often serve multiple objectives simultaneously

© 2025 TariffGlossary.com

Reciprocal tariffs differ from other types of import duties in several important ways:

Reciprocal Tariffs vs. Protective Tariffs

While protective tariffs are designed specifically to shield domestic industries from foreign competition, reciprocal tariffs primarily aim to create parity in trading relationships. The goal isn't necessarily protection but rather what the administration describes as "fairness" in trade terms.

Reciprocal Tariffs vs. Retaliatory Tariffs

Retaliatory tariffs are imposed specifically to counter another country's trade actions. While reciprocal tariffs may seem similar, they differ in that they attempt to match the overall tariff landscape rather than respond to a specific action. However, in practice, the line between these two types can blur.

Reciprocal Tariffs vs. Revenue Tariffs

Revenue tariffs are primarily designed to generate funds for the government. While reciprocal tariffs do generate revenue, their stated purpose is to address trade imbalances rather than fund government operations.

Economic Impact of Reciprocal Tariffs

Reciprocal tariffs have significant economic implications for various stakeholders:

For Businesses

- Importers: Companies importing goods from countries with high reciprocal tariff rates face increased costs, which may require adjusting supply chains, raising prices, or absorbing the additional expenses.

- Exporters: U.S. companies exporting to countries that impose retaliatory tariffs in response to U.S. reciprocal tariffs may see reduced demand for their products abroad.

- Domestic Producers: Some domestic producers competing with imports may benefit from reduced foreign competition, while others dependent on imported materials may face higher costs.

For Consumers

Consumers often bear at least part of the cost of tariffs, especially for products with few domestic alternatives. "Consumer costs are likely to rise more sharply for products for which there are no comparable substitutes." This can lead to higher prices across various product categories.

For the Broader Economy

The broader economic impacts include:

- Inflation pressure: Higher import prices can contribute to overall inflation.

- Supply chain restructuring: Companies may relocate production or seek alternative suppliers.

- Market volatility: Uncertainty about tariff policies can create stock market fluctuations.

- Potential for trade wars: Trading partners may respond with their own tariffs, potentially escalating into broader trade conflicts.

Key Facts: Reciprocal Tariff Impact

TariffGlossary.com- The 2025 reciprocal tariff framework affects over $2.7 trillion in annual U.S. imports

- Estimated $460-520 increase in annual household costs for the average U.S. family

- Over 65% of surveyed businesses reported plans to adjust their supply chains

- Trading partners have announced retaliatory tariffs on approximately $95 billion in U.S. exports

- Economists project a 0.3-0.7% reduction in GDP growth for 2025 due to tariff impacts

Arguments For and Against Reciprocal Tariffs

Arguments in Support

Proponents of reciprocal tariffs argue that they:

- Balance trade relationships: Create more equal trading conditions between countries

- Protect domestic industries: Shield American workers and companies from unfair foreign competition

- Provide negotiating leverage: Give the U.S. bargaining power to secure better trade terms

- Address persistent trade deficits: Help reduce the U.S. goods trade deficit

- Strengthen national security: Rebuild domestic manufacturing capacity in strategic industries

Arguments Against

Critics contend that reciprocal tariffs:

- Raise consumer prices: Increase costs for American consumers and businesses

- Risk retaliatory measures: Prompt trading partners to impose their own tariffs on U.S. exports

- Disrupt global supply chains: Create inefficiencies in established supply networks

- May violate international trade rules: Conflict with World Trade Organization commitments

- Misidentify causes of trade deficits: Target tariffs when deficits are often caused by broader macroeconomic factors

"The concept of reciprocal tariffs sounds fair on the surface—matching what other countries charge us. But international trade is far more complex than simple tariff rates. What we're seeing is a fundamental shift away from the multilateral rules-based trading system toward bilateral power politics."

— Dr. Sarah Williams, International Economics Professor, University of ChicagoPractical Implications for Businesses

If you're a business owner dealing with international trade, reciprocal tariffs have several practical implications:

For Importers

- Classify products accurately: Ensure correct Harmonized Tariff Schedule (HTS) codes for all imports.

- Track origin carefully: Tariff exposure is based on country of origin, not country of export.

- Monitor exclusions: Stay informed about product-specific exclusions that might apply to your imports.

- Explore tariff engineering: Consider whether product modifications could result in different classification.

- Investigate duty deferral programs: Look into foreign trade zones or bonded warehouses that might provide benefits.

For Exporters

- Monitor retaliatory measures: Stay informed about how other countries respond to U.S. reciprocal tariffs.

- Analyze market impacts: Assess how tariffs affect your competitiveness in foreign markets.

- Explore new markets: Consider diversifying export destinations to countries with lower tariff exposure.

- Communicate with customers: Keep foreign customers informed about potential price impacts.

Future Outlook

The future of reciprocal tariffs remains uncertain and will likely depend on several factors:

- Negotiation outcomes: The 90-day pause announced in April 2025 suggests openness to negotiations with trading partners.

- Economic impacts: The observed effects on inflation, employment, and economic growth may influence policy adjustments.

- International responses: How trading partners respond, both with their own tariffs and at multilateral forums like the WTO, will shape future developments.

- Domestic politics: Political considerations, including business and consumer reactions to tariff impacts, may influence policy direction.

Conclusion

Reciprocal tariffs represent a significant shift in U.S. trade policy, moving away from the multilateral approach that has dominated global trade relations for decades. While proponents see them as tools to create more balanced trade relationships, critics worry about their economic costs and potential to disrupt global commerce.

For businesses and consumers alike, understanding these tariffs is essential for navigating today's complex and evolving trade landscape. As with any major policy shift, the full impacts will become clearer over time as markets adjust and trading relationships evolve.

This article is for informational purposes only and does not constitute legal, tax, or customs advice. For specific guidance regarding your situation, consult with qualified professionals.

Want to learn more about other types of tariffs and international trade concepts? Explore our other resources at tariffglossary.com.

Related Articles

Types of Import Tariffs Explained: A Comprehensive Guide

Section 301 Tariffs Simplified: Understanding Their Impact in 2025

Stay Informed on Changing Tariff Policies

Get the latest updates on reciprocal tariffs, policy changes, and expert analysis of their impact on international trade delivered directly to your inbox.

Subscribe to Our Newsletter